Insurance Solutions to Protect You,

Your Family and your Livelihood...

Phone 813-532-5066

Marshall Veterinary Insurance

Patient Protection and Affordable Care Act (aka Health Care Reform, Obamacare)

What is Health Care Reform? What changes will it bring?

The Patient Protection and Affordable Care Act (PPACA) will change health insurance plan benefits and costs for consumers as Jan 1st, 2014. Some of these changes will cause increased costs to a consumer’s health insurance premium as a result of:

• The requirement that health insurance coverage be offered to everyone, even if they have a preexisting medical condition

• The requirement that all individuals maintain qualified health insurance or pay a penalty to the federal government

• The requirement that new "essential health benefits" be offered, such as maternity/pregnancy, substance abuse, mental health conditions and more

• The requirement that insurers charge the same health plan costs to men and women

• The limitation on how much your age can affect health plan costs

• New taxes and fees

Essential health benefits under the Patient Protection and Affordable Care Act will include the following general categories:

•Ambulatory patient services

•Emergency services

•Hospitalization

•Maternity and newborn care

•Mental health and substance abuse disorder services (including behavioral health treatment)

•Prescription drugs

•Rehabilitative services and devices

•Laboratory services

•Preventive and wellness services and chronic disease management

•Pediatric services, including oral and vision care

Reform says that plans of all sizes that cover benefits designated as Essential Health Benefits, including self-funded plans, must cover these benefits with no annual limits or lifetime maximums.

What is the Individual Mandate?

Tax penalties apply to individuals who do not maintain minimum essential health coverage beginning January 1, 2014. This is referred to as the individual mandate. The penalty is on a sliding scale for three years and is 1/12th of the greater of:

•For 2014, $95 per uninsured adult in the household or 1 percent of the household income over the filing threshold

•For 2015, $325 per uninsured adult in the household or 2 percent of the household income over the filing threshold

•For 2016-2017, $695 per uninsured adult in the household (maximum $2,085) or 2.5 percent of the household income over the filing threshold (maximum: yearly premium for the national average price of a Bronze plan sold through the Marketplace), whichever is greater.

The penalty will be 1/2 of the amounts for individuals under the age of 18. The following exceptions to the penalty for not maintaining minimum essential coverage apply to individuals.

•Religious reasons

•Not lawfully present in the United States

•Incarceration

•Inability to afford coverage where required contributions toward coverage exceed 8 percent of household income

•Income below 100 percent of the poverty level

•Hardship waiver obtained

•Not covered for a period of less than three months during the year

Coverage must be secured during the "Open Enrollment" period, which is November 1st - December 15th, with coverage effective beginning January 1st -or- tax penalties apply for each month a person goes uninsured.

What do the new plans look like?

Plans will be required to offer benefits based on an actuarial value -or- the percentage of benefits paid by the company versus those paid by the insured

Plan level Cost Share/Actuarial Values:

Platinum 90%

Gold 80%

Silver 70%

Bronze 60%

Catastrophic (individual only) Up to age 30 or exempt from mandate

What are Exchanges?

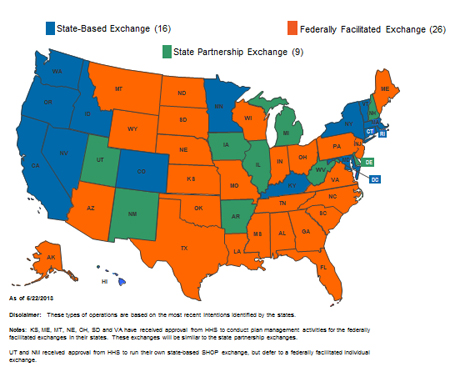

By October 1, 2013, Exchanges must be operational in each state to begin Open Enrollment for the 2014 plan year. The Exchange will make it easier for individual consumers and small businesses with fewer than 50 employees to compare plan offerings and buy health insurance.

A state may operate the Exchange on its own (a state-based Exchange), share operational functions with the federal government (a State Partnership Exchange) or allow the federal government to operate the Exchange within the state (a Federally-Facilitated Exchange).

Exchanges are essentially websites through which consumers can enroll in medical insurance. Those who will primarily purchase coverage through an exchange will be those individuals and families who qualify for "advance premium tax credits" to help offset the cost of the insurance premiums. In order to get these subsidies, the plan must be sold "on-exchange". This simply means the plan is legally filed as a plan eligible for premium assistance (if one qualifies). Coverage does not actually have to be purchased through the Federal Exchange/Marketplace website (healthcare.gov) , as it can be purchased through an insurance agent as well, which is highly recommended. It does not cost a person any more to use an insurance agent.

Those that do not qualify for premium assistance because they make too much money will primarily buy a plan "off exchange". Off exchange, companies are offering different plan options and in some ways better coverage. For example: most on-exchange plans being sold in Florida are HMO, meaning a primary care doctor is required and offer in-network benefits only. Plans on-exchange are also using medical provider networks that have been "slimmed down" with respect to the number and doctors and hospitals offered. Off-exchange many companies are offering PPO plan options, meaning a person can use any medical provider in-network and go out of network if they wish (at a reduced rate). PPO plans require no primary care doctor and no referral's are needed to see a specialist.

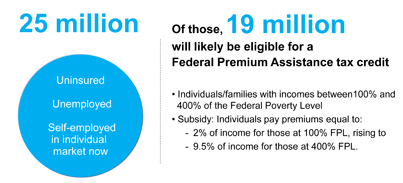

Advance Premium Tax Credits (aka Premium Subsidy)

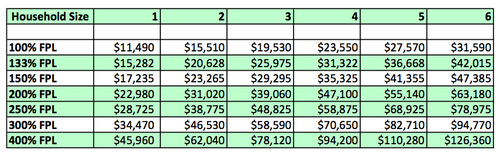

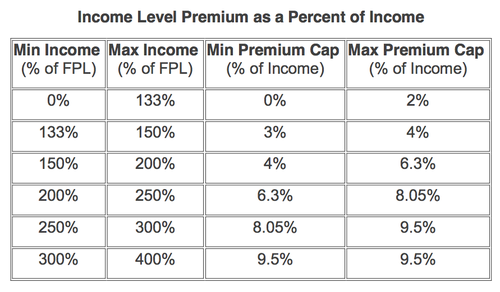

Beginning in 2014, a Federal Premium Assistance Tax Credit is available to eligible individuals to help subsidize the cost of insurance coverage purchased on-exchange. In order to be eligible, the individual’s household income must be between 100 percent and 400 percent of the federal poverty level, and the individual must either:

•Not be offered minimum essential coverage by an employer, or

•Be offered minimum essential coverage, but the coverage is (i) unaffordable (i.e., the cost of coverage exceeds 9.5 percent of the employees household income), or (ii) does not provide the required minimum actuarial value (the plan’s share of the total allowed costs of benefits is less than 60 percent).

Subsidies you qualify for are calculated using your projected modified adjusted gross income as recorded on your federal tax return (form 1040).

Subsidies apply to the Silver Level, however, they can be used towards any plan level chosen.

Federal Level of Poverty Levels by Household Size

To get an idea how subsidies might apply, click on the link below

With all these changes, who can help me secure the right plan?

Contact us today for a no obligation consultation and quotes! Or, visit our Quote/Enroll tab above for free, secure on-line quoting and plan enrollment!

Jeff is licensed and appointed with most major health insurance companies in over 35 states. Jeff is a authorized, registered broker with Federally Facilitated Exchange Marketplace for both individuals and small businesses. Depending on your unique situation, Jeff will recommend securing medical coverage on-exchange or off-exchange. This determination will be made based upon varying factors including: whether one qualifies for premium subsidies, company and plan availability or other factors discovered during consultation.